Progressive tax

Progressive tax is a taxation system where the tax rate increases as the taxable income or wealth of the taxpayer increases. This system is designed to ensure a more equitable distribution of wealth and to reduce income inequality within a society. The principle behind progressive taxation is based on the ability-to-pay concept, which argues that individuals who earn more can afford to pay a higher proportion of their income in taxes.

Principles of Progressive Tax[edit]

The core principle of progressive taxation is based on the concept of tax fairness. It operates under the assumption that those who have higher incomes can afford to contribute a larger share of their earnings to support public services. This is contrasted with a regressive tax, where the tax rate decreases as the income or wealth of the taxpayer increases, placing a relatively higher burden on lower-income earners. Another taxation system is the proportional tax, where the tax rate is fixed regardless of income level, also known as a flat tax.

Implementation[edit]

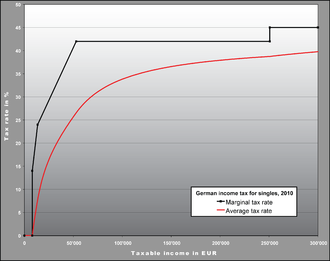

Progressive taxes are most commonly applied to income tax, where different income brackets are taxed at different rates. For example, a basic rate might be applied to income up to a certain threshold, with higher rates applied to income above that threshold. In addition to income tax, progressive taxation can also be applied to capital gains tax, estate tax, and wealth tax.

Advantages and Disadvantages[edit]

The main advantage of a progressive tax system is its promotion of social equity. By taxing higher income earners at a higher rate, it helps to reduce income inequality and provide more resources for public services and welfare programs. However, critics argue that progressive taxation can discourage investment and savings, reduce economic incentives for earning higher incomes, and lead to tax avoidance and evasion.

Global Examples[edit]

Many countries around the world implement progressive tax systems, with variations in the number and rate of income brackets. For example, the United States has a progressive federal income tax system with multiple tax brackets ranging from 10% to 37%. Similarly, countries like Sweden, Finland, and Germany have progressive tax systems with high top marginal tax rates, reflecting their commitment to social welfare and income redistribution.

Controversies[edit]

The implementation of progressive taxation often sparks debate. Supporters argue that it is essential for creating a fair and equitable society, while opponents claim it punishes success and undermines economic growth. The effectiveness of a progressive tax system in reducing income inequality depends on various factors, including the specific design of the tax brackets, the presence of tax loopholes, and the overall tax policy context.

Conclusion[edit]

Progressive taxation remains a key tool for governments aiming to reduce income inequality and fund public services. While it is not without its criticisms, the principle of taxing individuals based on their ability to pay is widely regarded as a fair approach to taxation. As economic conditions and societal values evolve, the debate over progressive taxation and its role in society is likely to continue.

Ad. Transform your life with W8MD's Budget GLP-1 injections from $75

W8MD offers a medical weight loss program to lose weight in Philadelphia. Our physician-supervised medical weight loss provides:

- Weight loss injections in NYC (generic and brand names):

- Zepbound / Mounjaro, Wegovy / Ozempic, Saxenda

- Most insurances accepted or discounted self-pay rates. We will obtain insurance prior authorizations if needed.

- Generic GLP1 weight loss injections from $75 for the starting dose.

- Also offer prescription weight loss medications including Phentermine, Qsymia, Diethylpropion, Contrave etc.

NYC weight loss doctor appointmentsNYC weight loss doctor appointments

Start your NYC weight loss journey today at our NYC medical weight loss and Philadelphia medical weight loss clinics.

- Call 718-946-5500 to lose weight in NYC or for medical weight loss in Philadelphia 215-676-2334.

- Tags:NYC medical weight loss, Philadelphia lose weight Zepbound NYC, Budget GLP1 weight loss injections, Wegovy Philadelphia, Wegovy NYC, Philadelphia medical weight loss, Brookly weight loss and Wegovy NYC

Linkedin_Shiny_Icon Facebook_Shiny_Icon Error creating thumbnail:

![]()

|

WikiMD's Wellness Encyclopedia |

| Let Food Be Thy Medicine Medicine Thy Food - Hippocrates |

Medical Disclaimer: WikiMD is not a substitute for professional medical advice. The information on WikiMD is provided as an information resource only, may be incorrect, outdated or misleading, and is not to be used or relied on for any diagnostic or treatment purposes. Please consult your health care provider before making any healthcare decisions or for guidance about a specific medical condition. WikiMD expressly disclaims responsibility, and shall have no liability, for any damages, loss, injury, or liability whatsoever suffered as a result of your reliance on the information contained in this site. By visiting this site you agree to the foregoing terms and conditions, which may from time to time be changed or supplemented by WikiMD. If you do not agree to the foregoing terms and conditions, you should not enter or use this site. See full disclaimer.

Credits:Most images are courtesy of Wikimedia commons, and templates, categories Wikipedia, licensed under CC BY SA or similar.

Translate this page: - East Asian

中文,

日本,

한국어,

South Asian

हिन्दी,

தமிழ்,

తెలుగు,

Urdu,

ಕನ್ನಡ,

Southeast Asian

Indonesian,

Vietnamese,

Thai,

မြန်မာဘာသာ,

বাংলা

European

español,

Deutsch,

français,

Greek,

português do Brasil,

polski,

română,

русский,

Nederlands,

norsk,

svenska,

suomi,

Italian

Middle Eastern & African

عربى,

Turkish,

Persian,

Hebrew,

Afrikaans,

isiZulu,

Kiswahili,

Other

Bulgarian,

Hungarian,

Czech,

Swedish,

മലയാളം,

मराठी,

ਪੰਜਾਬੀ,

ગુજરાતી,

Portuguese,

Ukrainian