Ornstein–Uhlenbeck process: Difference between revisions

CSV import |

CSV import |

||

| Line 48: | Line 48: | ||

[[Category:Financial mathematics]] | [[Category:Financial mathematics]] | ||

{{math-stub}} | {{math-stub}} | ||

<gallery> | |||

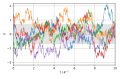

File:Ornstein-Uhlenbeck-5traces.svg|Ornstein–Uhlenbeck process | |||

File:OrnsteinUhlenbeckProcess3D.svg|Ornstein–Uhlenbeck process | |||

File:Leonard_Ornstein_mural,_Oosterkade,_Utrecht,_2021_-_1_(cropped)_-_Ornstein's_1930_random_walk_formula.jpg|Leonard Ornstein mural, Oosterkade, Utrecht, 2021 | |||

File:Leonard_Ornstein_mural,_Oosterkade,_Utrecht,_2021_-_1.jpg|Leonard Ornstein mural, Oosterkade, Utrecht, 2021 | |||

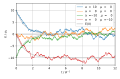

File:Ornstein-Uhlenbeck-traces-a-mu.svg|Ornstein–Uhlenbeck process | |||

</gallery> | |||

Latest revision as of 11:32, 18 February 2025

Ornstein–Uhlenbeck process is a type of stochastic process that describes the velocity of a massive Brownian particle under the influence of friction. It is named after Leonard Ornstein and George Eugene Uhlenbeck. The process is a stationary Gauss-Markov process, making it a continuous-time analog of the discrete-time autoregressive process of order 1, or AR(1) process. It is a solution to the Langevin equation with a linear restoring force and Gaussian white noise, representing a model for the velocity of a particle in a fluid undergoing Brownian motion.

Definition[edit]

The Ornstein–Uhlenbeck process \(U(t)\) can be defined as the solution to the stochastic differential equation (SDE):

\[dU(t) = \theta (\mu - U(t))dt + \sigma dW(t)\]

where:

- \( \theta > 0 \) is the rate of mean reversion,

- \( \mu \) is the long-term mean level,

- \( \sigma > 0 \) is the volatility,

- \( W(t) \) is a Wiener process, and

- \( t \) represents time.

Properties[edit]

The Ornstein–Uhlenbeck process exhibits several key properties:

- It is mean-reverting, meaning it tends to drift towards its long-term mean \( \mu \) over time.

- It is a stationary process, implying that its statistical properties do not change over time.

- It is a Markov process, indicating that future values of the process depend only on the current state, not on the path taken to arrive at that state.

- It has Gaussian increments, which means that the changes in the process over any two points in time are normally distributed.

Applications[edit]

The Ornstein–Uhlenbeck process has wide applications across various fields:

- In finance, it is used to model interest rates, currency exchange rates, and commodity prices.

- In physics, it models the velocity of a particle in a fluid.

- In biology, it can describe the fluctuation in populations or the spread of viruses.

- In engineering, it is applied in signal processing and control systems.

Mathematical Solution[edit]

The exact solution of the Ornstein–Uhlenbeck SDE is given by:

\[U(t) = U(0)e^{-\theta t} + \mu(1 - e^{-\theta t}) + \sigma \int_0^t e^{-\theta (t-s)} dW(s)\]

This solution shows how the process evolves over time from an initial state \(U(0)\).

See Also[edit]

References[edit]

<references/>

This article is a mathematics-related stub. You can help WikiMD by expanding it!

-

Ornstein–Uhlenbeck process

-

Ornstein–Uhlenbeck process

-

Leonard Ornstein mural, Oosterkade, Utrecht, 2021

-

Leonard Ornstein mural, Oosterkade, Utrecht, 2021

-

Ornstein–Uhlenbeck process